Living on a Budget - Tips to help you regain control of your finances

Every penny counts!

resources

Living on a budget

I am writing this hub in response to a weekly challenge. If I am honest some of my tips are addressed in another hub Simple Budgeting tips that help in the recession. I will try not to repeat myself here.

I have a small income, at the moment my kids are small and I try to balance getting income with being there for my kids at the end of school and nursery. It is a challenge. Even if I worked more the cost of childcare makes it hard.

We are currently largely a one income family and a one car family. The car is not that I would not love a car to dash about in, our budget is that I don't see how we can afford two cars.

Being a one car family (at least for a while)

I realise that this is not always practical for some. For other people you may not have considered it. I live in a semi rural area where the bus service is regular but can be annoying. Getting to the next village is costly and depending on your destination it could take 35 minutes by bus but 10 minutes in the car. My husband and I plan our week and see who needs the car when. Admittedly this has become easier since my hubby got a bicycle through his work cycle to work scheme. He now cycles the 7 miles to work most days, leaving me the car for the kids.

Having one car may be an option for you, especially if you live in an area that has a good subway or transport system.

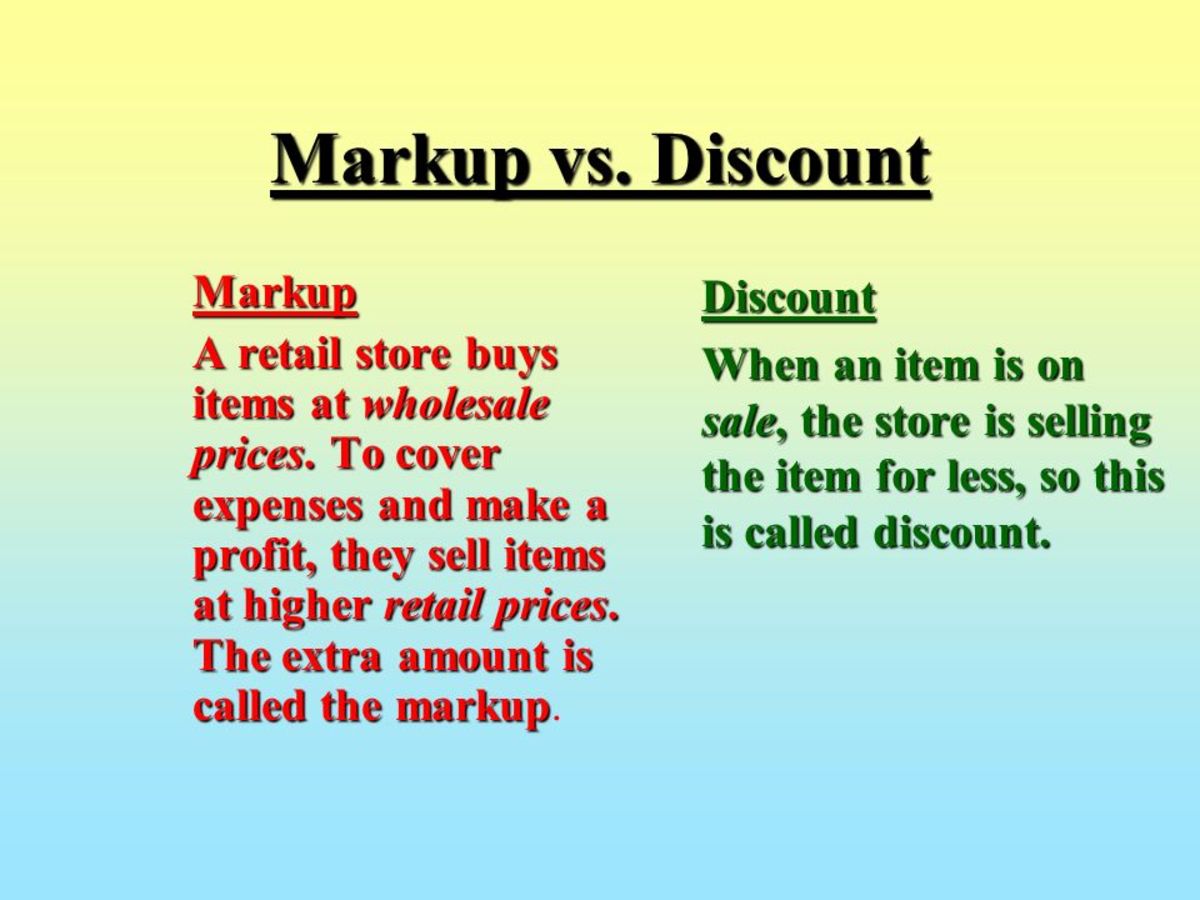

Reflect on what is a WANT and what is a NEED

There is a difference between wants and needs. We live in a consumerist society that wants everything instantly. I could say " I really want those knee high boots" or it could be that I need new boots because the others are leaking. In the same sense you need to prioritise what you are going to buy. I would love a DSLR but that is hobby and passion. If I really want it I can choose to save for it. If you have more than one thing you want, make a list.

Pay Bills First

This sounds simple. You would be surprised the number of people I see that have no money for the electricity but still managed to buy a new Gadget that month. Simple rule of thumb keep a roof over your head, feed and clothe the family THEN treats.

Cut down on costly treats.

I am not being mean but going out to the cinema with the family is costly. It is a treat. We still have lots of family fun though. We go on cheap days out or cycle or have a family night. Family night could be a night out or a night in with a DVD or game.

I also love my coffee. But I tend to buy a Latte once a week while my daughter is at tennis lesson. I look forward to my treat and I don't feel I am missing out. Treating yourself is nice but it ceases to be a treat if it is the norm. It also ceases to give pleasure if it causes stress from the debt. If you spend before you think, you can regret your actions.

Shop around (sometimes being loyal has no benefit)

Shop around for things. Go on comparison websites. This can be for anything. Whether it is for your utility bills or butcher meat, shop around. Websites like Uswitch are very good for checking who has the best tariffs at the moment.

Supermarkets are convenient but it pays to look at the prices and figure out who is cheapest. Some people have no idea the price of things, they just use their card at the till. Let me illustrate with a few examples:

Milk - My family love milk, we go through a lot. Our normal supermarket is not always the cheapest. There is a small store that can save us 65pence every 2 litres. We buy 4 litres every couple of days, so that can mount up, shopping in the expensive shop could be £3-4 a week - £12 -£16 a month, just on milk!

Meat - You may think that Supermarkets are the place to get this. For me however, I have discovered which shop is the best place to buy certain meats. Chicken is cheaper at the supermarket. Mince and some other meats are cheaper at the butcher. There is one butcher 8 miles away that is so reasonable that it is worth going to him for a big stock of meat that will last for 3 -4 weeks. He does special deals and the meat is good quality with less fat. It does mean I don't get the shopping done in one fell swoop but I know its saving money.

It does mean I use fuel but I tend to do all my chores for that area together so I am not doing extra trips.

The point is shop around. Compare goods and quantities.

Home Cooking

Convenience food can sometimes take as long in the microwave than starting from scratch. Home cooking is normally tastier too. If you live alone you can even make a big batch of something and freeze it. I have a friend who is really busy weekdays, but loves cooking. On a Friday or Saturday she cooks up a storm. She makes big pots of 3 or so dishes and freezes them in smaller portions, so that she can use them during the week. She does this because she lives alone and because when she comes in on a weekday she tends to be tired and hungry. She knows however that she can pull out something she prepared earlier on and it is less for her to do.

Hope these ideas help you ... I may add to them. Happy saving!